Money

Good news! This bank offers up to 9.25% on FDs

Fixed deposit (FD) is one of the most preferred investment avenues in India due to fixed interest rate for the investment tenure and guaranteed maturity value, which makes the capital free of investment risks. Moreover, to invest in FDs, an investor need not open a demat account or fulfill some stringent guidelines, which makes the investment process easy for people.

Although the interest rate on FDs remains fixed for the tenure of investment, but the overall interests rate across the financial institutions depend on the state of economy and vary closely with the rate of inflation.

For example, the Reserve Bank of India (RBI) hikes policy rates when the inflation is high to encourage people to save more and spend less, leading to lower demands for goods and services and hence lower price level. The central bank also hikes reserve rates to make lower amount of currency available in the economy, which also results into lower demand and helps reduce the rate of inflation.

However, when the inflation level is low, the RBI reduces the policy rates to enhance money circulation to hike demands and to boost the economic activities.

For some years now, the inflation is at single digit level, which allows the RBI to keep the policy rates at a lower level. But lower policy rate means lower lending (interest on loans) as well as lower borrowing (interest on FDs) rates.

While cheaper loan rate is a welcome measure to boost borrowing and productions, corresponding lower interest rate on deposits makes investors worried, especially senior citizens, who depend on risk-free deposits to protect their hard-earned retirement corpus and get regular interests to meet their expenses.

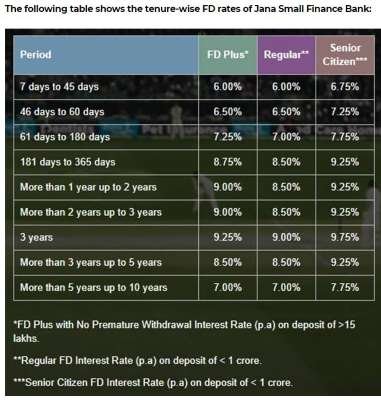

So, at this low interest rate regime, getting some extra rates on time deposits are a great relief for senior citizens as well as risk-averse investors and the good news is that Jana Small Finance Bank is now offering higher interest rate of 9.75 per cent for senior citizens on 3-year FDs, while the rate for citizens below 60 years of age on 3-year FD is 9 per cent and on 3-year FD Plus is 9.25 per cent. However, to avail the extra interest of FD Plus, one has to invest Rs 15 lakh or more and that too without the option of premature withdrawals.

Not only on 3-year deposits, the overall FD rates of Jana Small Finance Bank varies from 6 per cent to over 9 per cent, while the FD rates of big scheduled commercial banks vary from 3.5 per cent to 7 per cent.

The following table shows the tenure-wise FD rates of Jana Small Finance Bank:

-

Health3 days ago

Is Drinking Cold Water Bad for Your Health? Understand the Benefits and Risks

-

Money3 weeks ago

Oswal Pumps IPO: Date, Price, GMP, Allotment & Full Review

-

Money2 weeks ago

How to File ITR Online Without a CA in 2025 – Step-by-Step Guide

-

Beauty6 days ago

Real Reason Behind Dark Underarms: Health Warning Signs, Not Just a Beauty Concern

-

Cryptocurrency2 weeks ago

Why You Should Never Buy Celebrity Memecoins | Crypto Scams Explained

-

Money3 weeks ago

HDB Financial IPO 2025: Dates, Price, Review & Allotment Details

-

How to7 days ago

Transform Your Photos into Stunning Studio-Style AI Portraits with ChatGPT in 3 Simple Steps

-

Money2 days ago

Best SIP Mutual Funds 2025: Top 10 High-Return Schemes with up to 27% CAGR