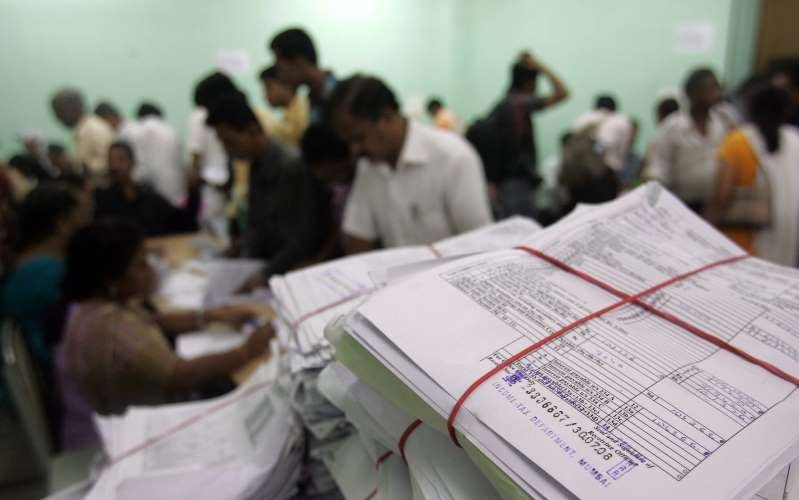

Money

Parents, children & spouse can help you save tax

When it comes to tax saving, Section 80C is among the popular go-to avenues to avail exemption on investments. If you have exhausted all options in your personal capacity, then your parents, children and spouse can help you reduce your tax liability. Let’s look at some of the ways in which your dependents can help you save taxes.

Tuition fees for children

You can claim deduction benefits under Section 80C up to Rs 1.5 lakh for payments made for tuition fees for your children. You can claim this benefit for payment of school fees for up to two children. You can also consider investment in the Sukanya Samriddhi Yojna for up to two girl children to avail benefits under the same section.

Insurance premiums for parents

Paying for health insurance premiums for any dependent – your wife, children – and self can allow you deduction of up to Rs 25,000 under Section 80D. Through the premium payment for your parents, you can get an additional deduction of Rs 25,000. If your parents are senior citizens, you can claim a deduction of up to Rs 50,000.

Education loan

For education loan taken for your children, you can claim tax deduction under Section 80E. Interest payment on education loan is entirely tax free for the relevant financial year. And there’s no ceiling on the amount.

Gift money to parents and children for investment

Senior citizen individuals get a basic tax exemption of Rs 3 lakh; while super seniors, i.e. people above the age of 80 years, get basic tax exemption of Rs 5 lakh.

To save tax, you can gift a certain amount of money to your parents and they can invest it in a fixed deposit or other investment instruments. Gift money at the hands of family members are not taxed. So, if your parents fall in a lower tax bracket than you, tax deduction on the interest or return earned on such income would be low. Your parents can avail further tax deduction by investing in instruments eligible for tax deduction under Section 80C.

Similarly, you can transfer the money to your non-minor children, provided they fall in a lower tax bracket than you to reduce tax liability.

Pay rent to your parents

Salaried individuals can avail tax deduction by paying rent to their parents if they live in their parents’ home. The tax deduction can be availed in the form of HRA exemption benefit. However, the house needs to owned or co-owned by the parents and you cannot be one of the co-owners. The rental payment would be taxable in the hands of the parents and it will be taxed as per the applicable tax slab. If you do not get HRA benefit, you can claim for tax benefit under Section 80GG.

-

Health2 days ago

Is Drinking Cold Water Bad for Your Health? Understand the Benefits and Risks

-

Money3 weeks ago

Oswal Pumps IPO: Date, Price, GMP, Allotment & Full Review

-

Money2 weeks ago

How to File ITR Online Without a CA in 2025 – Step-by-Step Guide

-

Cryptocurrency2 weeks ago

Why You Should Never Buy Celebrity Memecoins | Crypto Scams Explained

-

Beauty5 days ago

Real Reason Behind Dark Underarms: Health Warning Signs, Not Just a Beauty Concern

-

Money3 weeks ago

HDB Financial IPO 2025: Dates, Price, Review & Allotment Details

-

How to6 days ago

Transform Your Photos into Stunning Studio-Style AI Portraits with ChatGPT in 3 Simple Steps

-

Technology2 weeks ago

10 Best AI Code Generators in 2025 (Free & Paid Tools Reviewed)