Cryptocurrency

Stablecoin Transactions Increase 1,032% in November

Recent exchange listings have helped Tether competitors gain traction.

2018 rapidly became the year of the stablecoin with numerous dollar-pegged coins launching to compete for market share with Tether (USDT).

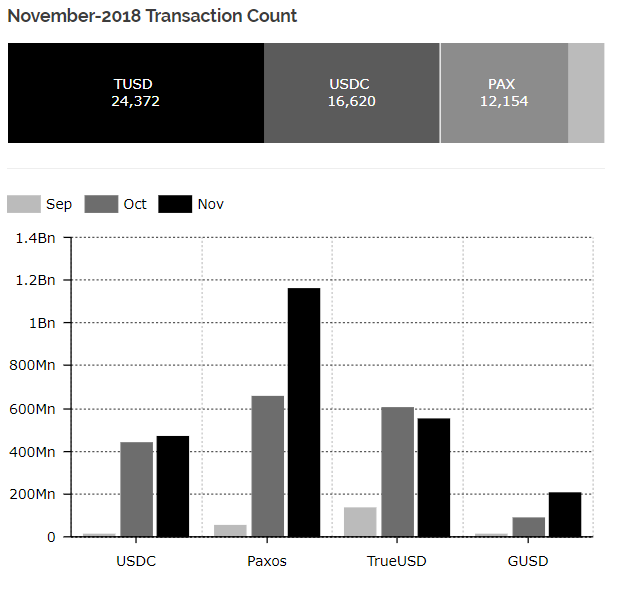

According to a recent report by market research firm Diar, the adoption of the major stablecoin alternatives, including USD Coin (USDC), True USD (TUSD), Paxos (PAX) and Gemini USD (GUSD), has accelerated in the previous three months as on-chain transactions jumped a whopping 1032% between October and November.

The four stablecoins have seen more than $5 billion in on-chain transactions within a short 3-month period. While TrueUSD saw a decrease in transaction value, the number of transactions still increased from October to November.

The report does not dive into the exact cause of the surge in on-chain transactions, but it is likely partially due to increased adoption by major cryptocurrency exchanges.

Most recently, Bitfinex, one of the world’s leading cryptocurrency exchanges, and its Ethereum-based decentralized exchange, Ethfinex Trustless, are now offering the six leading stablecoins.

This news came shortly after Binance announced the renaming and expansion of its Tether market to USDⓈ, which now includes a variety of popular stablecoins with an expanded assortment of trading pairs.

-

Health1 week ago

Is Drinking Cold Water Bad for Your Health? Understand the Benefits and Risks

-

Money3 weeks ago

How to File ITR Online Without a CA in 2025 – Step-by-Step Guide

-

Cryptocurrency3 weeks ago

Why You Should Never Buy Celebrity Memecoins | Crypto Scams Explained

-

Money1 week ago

Best SIP Mutual Funds 2025: Top 10 High-Return Schemes with up to 27% CAGR

-

Beauty2 weeks ago

Real Reason Behind Dark Underarms: Health Warning Signs, Not Just a Beauty Concern

-

Money4 weeks ago

Oswal Pumps IPO: Date, Price, GMP, Allotment & Full Review

-

Money7 days ago

Best Budgeting & Expense-Tracking Apps for 2025: Top Tools to Master Your Money

-

Money1 week ago

Top 5 Safe Investment Schemes for Retired Indians Seeking Monthly Income