It’s stated that we first make our habits, after which our habits make us. Save extra, spend much less and keep away from pointless debt are...

New Delhi: EPFO gives varied facilities to its subscribers, utilizing which they will examine their account balance. EPF will be checked by PF subscribers in 4...

Nazara Technologies is backed by ace investor Rakesh Jhunjhunwala. The IPO of Nazara Technologies will open for pub subscription on Wednesday. The shares of Nazara Technologies...

The initial public offer (IPO) of Kalyan Jewellers India opened for public bidding on Tuesday. Analysts say the issue is richly valued but there are reasons...

The initial public offering or IPO share allocation of the Easy Trip Planners Private Limited will be finalised on Tuesday, March 16, 2021. Investors who have...

The EPFO decides the speed of curiosity for the EPF scheme on a yearly foundation The Central Board of Trustees of Workers’ Provident Fund Organisation (EPFO)...

Find out how to turn into a crorepati is without doubt one of the most typical questions that tax and funding consultants reply each day. Nevertheless,...

A personal loan is an easy way to fulfil a short-term cash need. This loan is easy to avail and requires no asset to be offered...

Sandeep Verma and his wife Jyoti had been living in a two BHK (bedroom-hall-kitchen) rented apartment since 2014. While the rent was initially Rs 15,000 a...

Loans can be extremely helpful in meeting the financial shortages stopping you from achieving your financial goals. However, loan approval primarily depends on your credit risk...

Despite job losses or salary cuts, there are some expenses that many of us cannot curtail. Paying our children’s school fees is one of them. Mumbai-based...

Today, cryptocurrency is one of the most trending topics due to the current macroeconomic uncertainty caused by the COVID-19 pandemic. With exorbitant returns generated by most...

With contracting global output, global economies in a deeper recession than anticipated, and dearth of good returns in many other asset classes, gold has emerged as...

With the Covid-19 induced lockdown affecting cash flows, making regular loan payments has become challenging for many people. For those who have taken home loans where...

We are living in unusual times. The coronavirus pandemic has resulted in unprecedented city lock-downs, quarantines, sealed international borders, and volatile markets. Taking care of our...

The Public Provident Fund comes with various benefits along with its tax benefits and the advantage of compounding of returns. According to the changes made in...

The growth of the Indian economy has slowed down over the last two years. The Sino-American trade war, a slowdown in the global economy, falling rupee,...

While investing in mutual funds, investors get the opportunity to earn more through the power of compounding over a period of time, as compared to other...

How much gold you can keep at home without fearing Income Tax raid The Union government is said to be mulling a plan to put a...

Mutual Fund SIP Investment: Are you saving right amount? Know the ‘missing’ link Inflation plays an important role in the process of investing, especially over the...

Editor’s note: The opinions in this article are the author’s, as published by our content partner, and do not represent the views of Regularstation It won?t...

How SIP calculator works: Find out how much to save to become a crorepati Crorepati Calculators: To start investing in equity mutual funds, one is often...

PAN cards to be issued online instantly using Aadhaar In a bid to promote digitisation, the Income Tax (I-T) Department is set to launch a facility...

In the event of death, the units usually get transferred to the nominee. However, the mutual fund needs to be in the name of one investor...

Employee Provident Fund: Working in exempted establishment? Court says this about your pension Provident Fund, Pension for Exempted Establishment: Is an employee of an exempted establishment...

5 investment options this Diwali to become rich Diwali is a great time to have a relook at your portfolio. Markets are poised to do well,...

Mutual Fund Vs Fixed Deposit: What makes MFs different from FDs? Does volatility only pose risks or provide opportunities? Fixed deposit (FD) is the most popular...

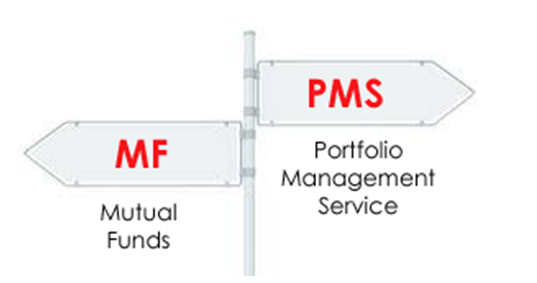

Portfolio Management Services (PMS) vs MF: How both investments have fared in 5 years In the last five years, Mutual Fund sector has seen a “spectacular...

A taxpayer is eligible to receive an income tax refund when excess taxes have been paid by him either through tax deduction on payments made to...

Although making one crore with moderate monthly investment without equity exposure is difficult, periodic investment in Public Provident Fund (PPF) for a long-term can do the...